I Have Enough Money Only To Die

Robert Frank, The Americans. Via Addison

I didn’t come from a “humble beginning,” nor do I consider my childhood privileged. Maybe a two-parent household holds weight in a Black family, but that leverage dissolves quickly when you factor in resentment, dissatisfaction, and emotional abuse. Still, one thing rings true across many Black households when it comes to passing down “gems” about success: You need to go to school to make something of yourself.

There was no room to dream out loud without college on the table. I told my mom at 12 that I wanted to be a musician. No school. No degree. Just music. She treated it like I had spat in her face. I had to clarify that I meant no disrespect, but it didn’t matter. By the time the conversation ended, the decision had been made for me: I was going to college.

In my family—and many like mine—student debt wasn’t a crisis. It was a fact. A normal, permanent fixture of life. A bill you pay like rent, like groceries. As something intrinsic to existence. Like breathing, like scratching an itch. If they weren’t worried, why should I be? The indoctrination had already begun.

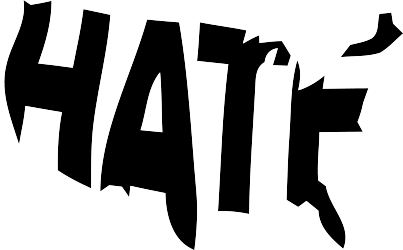

Even if you didn’t grow up poor, you were still sold the same poison: the “financial promise of education.” It was the good debt, the noble debt, the bootstrap express. Refuse to drink and you were lazy, unserious, doomed. And so we all drank. We were offered five- and six-figure loans at 18 years old, while grown adults with years of financial history couldn't get approved for a fraction of that to start a business or pay off medical bills.

And what did we get for it?

We sat in classrooms, memorizing theories and swallowing anxiety like breakfast. We trauma-bonded with classmates, kissed the asses of tenured academics who hated students, and prayed to gods we didn’t believe in just to make it to graduation. Then came the bill.

Was It Worth It?

Life after school feels like a bad episode of Severance. The hopeful, naive pre-college self disappears the moment you enter the workforce and realize you were conned. You sacrificed years and money for a piece of paper that couldn’t buy you freedom.

The debt never leaves. The salaries are lies. The system is rigged by…